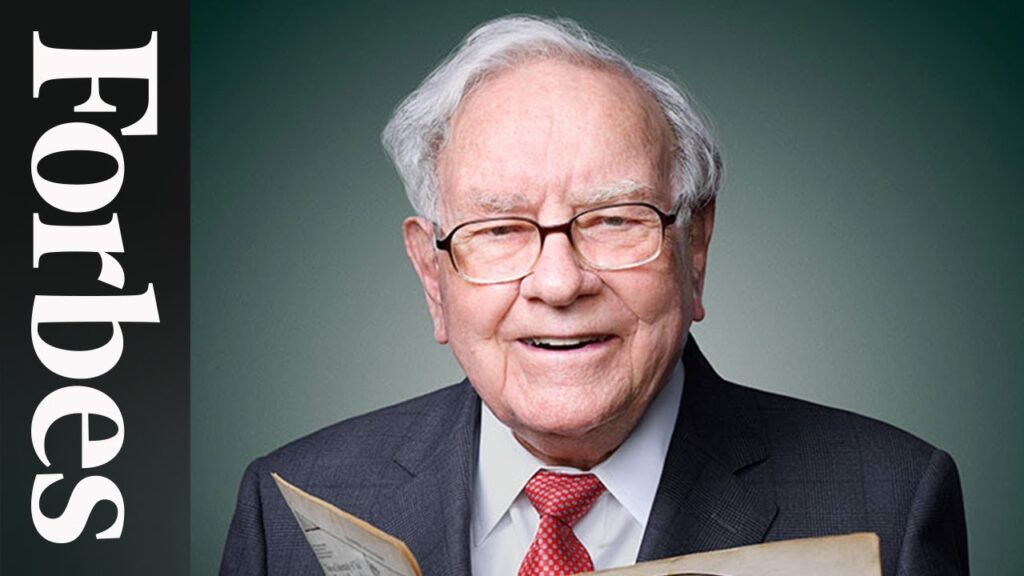

Warren Buffett, one of the most influential investors in the world, announced that he will step down as CEO of Berkshire Hathaway at the end of 2025, after over 60 years of leading the company. Known as the “Oracle of Omaha,” Buffett turned Berkshire Hathaway from a struggling textile company into a multibillion-dollar conglomerate with investments in companies such as Geico, Dairy Queen, and See’s Candies, among others.

Buffett, 94, has been the driving force behind Berkshire Hathaway’s immense success. Under his leadership, the company’s stock price has surged, making him one of the wealthiest individuals on the planet. His departure marks the end of an era, but Buffett has recommended Greg Abel, Berkshire Hathaway’s Vice Chairman, as his successor. Abel has been with the company for decades and has played a critical role in managing Berkshire’s vast portfolio of businesses. Buffett has expressed confidence in Abel’s ability to continue the company’s success.

For many investors, Buffett’s retirement represents a significant moment in financial history. He has not only shaped the landscape of American business but has also been a model for long-term investing, famously advocating for patience and discipline. Buffett’s influence has reached far beyond the financial world, with his philanthropic efforts, particularly his commitment to giving away the majority of his wealth through the Giving Pledge, cementing his legacy as one of the most respected figures in business.

As Warren Buffett transitions into retirement, the future of Berkshire Hathaway is in capable hands, and his legacy will undoubtedly continue to shape the world of investing for years to come.